- How do I start investing with Syfe?

- Can I open an account if I am not an Australian resident?

- Do I need to have an Australian bank account before I can invest?

- Are there any charges for opening a Syfe account?

- What is the minimum age to invest with Syfe?

- Can I open joint accounts with my loved ones?

- What happens if Syfe gets acquired or stops operating?

- What is Driver Licence Card Number and why is it needed to open my Syfe account?

Getting Started

Support centre

How can we help you invest better?

Getting Started

-

If you are new to Syfe, follow these three steps to start investing:

1. Download the Syfe app from the App Store or Google Play.

2. Signup for a Syfe account.

3. Once KYC completed, transfer funds to your Syfe account using bank transfer.

Done! You are ready to start investing. You can access your Syfe account anytime via our app.

If you have any issues creating your account, simply drop us an email at support.au@syfe.com.

View more -

Yes, you can! Syfe does not restrict non-Australian residents from opening accounts if this is not prohibited in your respective jurisdiction.

However, please note that due to regulatory restrictions, Syfe's offerings are currently not available to US citizens, and residents, or green card holders, Canada and China citizens or residents.

Applications are also reviewed on a case-by-case basis taking into account multiple factors which may include the source of funding. Funding from Australia is not a pre-requisite although there are some countries in which we may not accept funds from. Nonetheless, we regularly review and endeavor to expand the list of accepted countries where possible.

View more -

No, that is not necessary. If you do not have an Australian bank account, you may do a wire/Telegraphic Transfer. Alternatively, you may use remitting platforms like Wise or Revolut to transfer funds.

View more

However, if you do have a OSKO enabled Australian bank account you can make almost real time funds transfer. -

No. Opening an account with Syfe is free. Likewise, for maintaining a no investments account, you will not be levied any charges.

View more

When you are ready to invest, you can invest the amount you prefer to invest and at any time. -

The minimum age required to open an account with Syfe is 18 years old.

View more -

This feature is currently not available at this point in time but we will be looking to add this feature in the future.

View more -

At Syfe, the security of our clients' money is of the utmost importance to us. We have stringent measures in place to prevent an event, like a closure from happening. Syfe is a Corporate Authorised Representative (Number 1295306) of Sanlam Private Wealth Pty Ltd, an Australian Financial Service Licensee (number 337927). Syfe falls under a regulatory framework and complies with the regulatory requirements to ensure it always maintains the required financial resources.

Funds in your Syfe account are held on trust by JPMorgan Chase Bank, N.A. (“JPMC”). Our custodian for US securities is Alpaca Securities LLC ("Alpaca"), a member of the Securities Investor Protection Corporation (SIPC) and the SIPC protection extends to Syfe customers against any loss of US securities up to USD 500,000 in the unlikely event of a brokerage failure of an SIPC member, which includes a USD 250,000 limit for cash. SIPC does not protect you for any decline in the value of your securities. For additional details, please visit www.sipc.org.

Cryptocurrency digital assets on behalf of customers are custodied by Alpaca Crypto LLC’s one or more counterparties and/or the institutional-grade qualified custodian(s) for such counterparties. Your funds and assets are held separately from Syfe’s. This means that we will never be able to use your funds and assets, even in the very unlikely event that Syfe stops operating.

View more

In that unlikely scenario, we will work together with JPMC and Alpaca to ensure the orderly transfer of funds and assets to other licensed financial institutions, or the return of all funds and assets to our customers. Customers will be able to choose their preferred means.

Customers are also free to withdraw their money any time they wish. Syfe does not impose any exit penalties or lock-in periods and clients are genuinely able to access their money at any time. -

From 1 September 2022, the card number on a driver license will be a mandatory verification field for NSW, ACT, SA, TAS, NT and WA issued licenses. This change does not impact VIC & QLD at the moment.

With this change, new customers who opt for driver license verification to sign up for a Syfe account from 1 September 2022 will need to provide both the license number and card number along with the other mandatory driver license details.

The table below provides a summary of the current status in each State and what it means for you.

State of Issue Status When will the card number be mandatory? What does this mean for customers? NSW, ACT, SA, TAS, NT & WA All active and not expired NSW, ACT, SA, TAS & NT card numbers will be available via DVS by 1 Sept. 2022 1 Sept. 2022 Must capture driver license card number starting 1 Sept 2022, otherwise verification will fail. VIC & QLN No card number data available via DVS In 2023 No impact on matching. What is Driver License Card Number?

Driver License card number is a unique identifier which is updated each time a driver's license is re-issued. All active and not expired cards will have a card number printed on them and that card number can be verified via the DVS.

Including card number in the matching criteria ensures that the document being presented is the most recently issued document. This will minimize the risk of identity theft using a stolen or lost driver by ensuring that only the most recently issued card will verify.

Will the card number be included in Digital Driver Licenses?

NSW digital driver licenses already include the card number. SA is in the process of adding the card number to the SA digital license. QLD is in the process of rolling out a digital license and it will include the card number.

How is the card number different to a license number?

License number is an existing field and is already mandatory. Card number was never used for verification and will now be used, based on each state’s timeline. The license number identifies the individual while the card number is used to verify that it is the latest card.

Where is the card number located? Is it the same for all jurisdictions?

The location of the card number field differs between jurisdictions, and for NT driver licenses, it can differ depending on the issuing date.

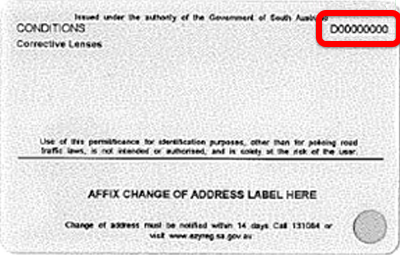

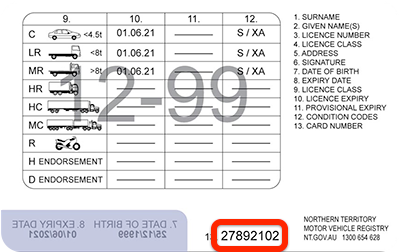

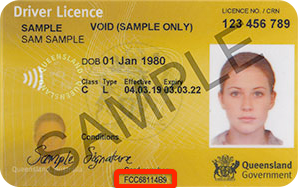

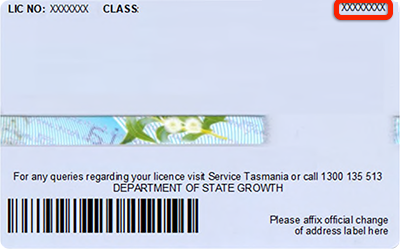

For driver license card number field image samples, refer below samples:

Name of State Sample New South Wales (NSW)

Australian Capital Territory (ACT)

South Australia (SA)

Northern Territory (NT)

Queensland (exempt)

Western Australia (WA)

Tasmania

Victoria (exempt)

Once unable to be verified with the driver license, will I be able to verify using other documents?

Yes, customers will be able to continue verification using other documents (e.g. Passport or Medicare card).

If you have any questions or concerns please reach out to us at support.au@syfe.com.

View more

Still need help?

Reach out to our customer support team at any time-

Daily support available

Chat with customer support

-

1800 577 398

Call us

-

support.au@syfe.com

Email us